Warren Buffett Claims Stocks Outshine Real Estate: A Different Perspective

May 9, 2025 - 14:37

Warren Buffett recently expressed his belief that investing in stocks is less challenging than investing in real estate. While his experience and success in the stock market are undeniable, this perspective may not resonate with everyone. For many investors, real estate presents unique opportunities that can be both rewarding and manageable.

Real estate investing offers tangible assets that can appreciate over time, providing a sense of security that stocks may not always deliver. Additionally, property ownership can generate consistent cash flow through rental income, which is particularly appealing in uncertain economic climates. Investors can also leverage real estate to maximize returns while diversifying their portfolios.

Furthermore, the real estate market is often less volatile compared to the stock market, which can experience sudden fluctuations. For individuals willing to do their homework and engage with their investments, real estate can be a viable and lucrative option. Ultimately, the best investment strategy varies by individual, and many may find that real estate aligns better with their financial goals and risk tolerance.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

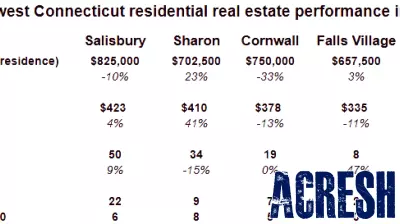

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...