Thousands of Idaho Homeowners Could Face Big Tax Bills When They Sell

July 11, 2025 - 09:15

A recent analysis reveals that over half of homeowners in Idaho may be unprepared for a significant financial surprise when they decide to sell their properties. The rapid appreciation of home values in the state, coupled with outdated tax exemptions, is creating a potential hidden home equity tax that could impact many sellers.

As property values soar, many homeowners are finding themselves in a position where the gains from their home sales exceed the current exemption limits. This situation could lead to unexpected tax liabilities, affecting their overall profit from the sale. The implications of this trend are particularly concerning for those who have owned their homes for several years and are now looking to capitalize on their investments.

With the housing market continuing to evolve, experts urge homeowners to familiarize themselves with the potential tax implications of selling their homes. It is crucial for sellers to seek advice and prepare for the financial realities that may arise from the current economic climate.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

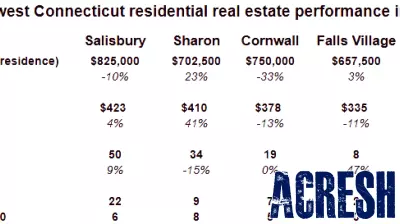

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...