Struggles of Proptech Startups: Divvy Homes and EasyKnock Face Challenges

January 18, 2025 - 22:38

Many proptech startups, born and funded during the low-interest-rate heydays, are in the throes of struggle. With investments into U.S.-based real estate technology experiencing a significant downturn, companies like Divvy Homes and EasyKnock are feeling the pressure. Once seen as pioneers in the industry, these startups are now grappling with a rapidly changing market landscape.

The rise in interest rates has led to increased borrowing costs and a slowdown in housing demand, creating a challenging environment for proptech firms. Divvy Homes, which aimed to make homeownership more accessible through its rent-to-own model, is now facing difficulties in scaling its operations. Similarly, EasyKnock, which offers homeowners the ability to sell their homes while retaining the right to live in them, is also encountering headwinds as consumer sentiment shifts.

As the proptech sector navigates these turbulent waters, many investors are reevaluating their strategies. The future remains uncertain for these startups, highlighting the volatile nature of the real estate technology market.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

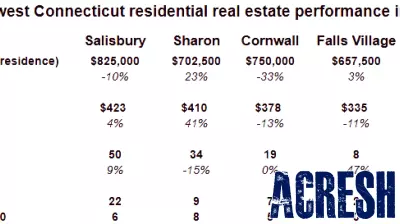

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...