Rising Home Prices in Tennessee Bring Hidden Capital Gains Tax Concerns

July 13, 2025 - 12:00

Tennessee’s home prices are up—but so is tax exposure. More homeowners are now facing the possibility of federal capital gains taxes when they decide to sell their long-held properties. Recent data reveals that approximately 36.1% of homeowners in the state may encounter this hidden tax burden, catching many off guard as they consider selling their homes.

As the real estate market in Tennessee continues to thrive, homeowners who have owned their properties for years may be surprised to learn that the appreciation in value could lead to significant tax liabilities. The capital gains tax applies to the profit made from selling a home, which can be substantial in a market where home values have surged.

This situation is particularly concerning for those who may not have factored in these potential costs when planning their financial futures. Homeowners are encouraged to consult with tax professionals to understand their exposure and explore strategies to mitigate the impact of these taxes as they navigate the evolving real estate landscape.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

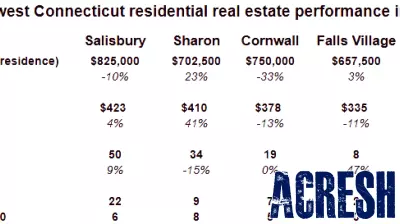

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...