Promising Real Estate Stocks Amid Rising Housing Prices in Canada

April 24, 2025 - 11:24

As housing prices continue to climb across Canada, certain real estate stocks are emerging as strong investment options. While the real estate sector can be volatile, some companies are positioned well to capitalize on the current market trends.

Investors are closely monitoring the performance of these stocks, as the demand for housing remains robust despite economic fluctuations. Factors such as low interest rates, a growing population, and urbanization are driving prices higher, creating opportunities for real estate firms that can adapt to changing market conditions.

Analysts suggest that investors should focus on companies with solid fundamentals, including strong balance sheets and effective management teams. These firms often have diverse portfolios that can weather economic downturns, making them more resilient in uncertain times.

As the Canadian housing market evolves, savvy investors may find that selecting the right real estate stocks could yield significant returns, even amidst broader market challenges.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

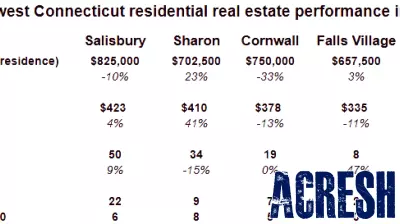

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...