Marion County 2024 Real Estate Tax Bills Released: Key Details

January 18, 2025 - 11:07

The first half of the 2024 real estate tax bills for Marion County have been issued, with a due date set for February 5. Property owners are encouraged to review their bills promptly to ensure timely payment and avoid penalties.

Payments can be made through various convenient methods, including in-person at designated locations, by mail, or online through the county's official payment portal. Additionally, several local banks will also accept tax payments, providing further options for residents.

It is essential for property owners to be aware of any changes in their tax assessments or rates that may have occurred since the last billing cycle. Keeping track of these details can help avoid unexpected financial burdens. As the due date approaches, taxpayers are advised to plan accordingly to meet the deadline and maintain good standing with local tax authorities.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

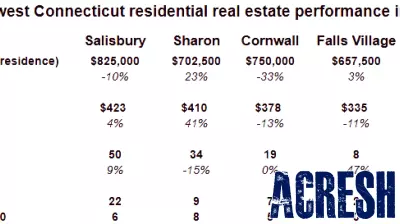

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...