Is Montgomery County Facing Redlining by the National Real Estate Sector?

February 3, 2025 - 16:23

Montgomery County and the Maryland suburbs of Washington, D.C. have recently come under scrutiny from a prominent national real estate writer. In a compelling critique, the writer suggested that these areas are experiencing a form of redlining, a practice historically associated with racial discrimination in housing.

The commentary highlights how certain neighborhoods within Montgomery County are being overlooked by developers and real estate investors, leading to a lack of investment and opportunities for residents. This situation raises concerns about equity in housing and access to resources, particularly for marginalized communities.

The writer pointed out that while some regions are thriving with new developments and rising property values, others are stagnating, which could perpetuate socioeconomic divides. The implications of this observation are significant, as it calls into question the fairness of the real estate market and its impact on community growth. As discussions around housing equity gain momentum, Montgomery County's situation may serve as a critical example of the challenges many suburban areas face in achieving balanced development.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

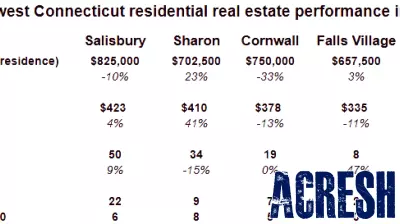

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...