Iraq Implements Stricter Regulations on Real Estate Transactions to Fight Money Laundering

January 21, 2025 - 10:42

Baghdad – In a significant move to enhance financial integrity, the Central Bank of Iraq (CBI) has announced new regulations aimed at combating money laundering and terrorism financing within the real estate sector. The updated measures include a reduction in the threshold for cash transactions, which will now require greater scrutiny from financial institutions and real estate agents.

Under the new rules, transactions exceeding a specified limit will necessitate detailed documentation and verification processes. This initiative is designed to ensure that all real estate dealings are transparent and traceable, thus minimizing the risk of illicit financial activities. The CBI emphasized that these regulations are crucial for maintaining the integrity of the financial system and fostering a secure investment environment.

In addition to cash transaction limitations, the CBI plans to enhance training for real estate professionals on compliance and reporting obligations. This comprehensive approach aims to strengthen the overall framework for monitoring and addressing potential financial crimes in Iraq's burgeoning real estate market.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

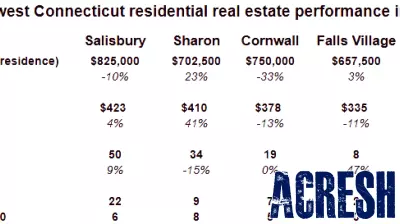

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...