Flagship Communities REIT Reports First Quarter 2025 Financial Results

May 14, 2025 - 05:23

TORONTO, May 13, 2025 – Flagship Communities Real Estate Investment Trust has announced its financial results for the first quarter of 2025. The results are prepared in accordance with International Financial Reporting Standards (IFRS) as set by the International Accounting Standards Board.

This quarter marks a significant period for the REIT, showcasing its growth and performance in the real estate sector. The financial statements, presented in U.S. dollars, highlight the REIT's ability to navigate the current market landscape effectively. Investors and stakeholders are keenly analyzing these results to gauge the organization's financial health and future prospects.

Flagship Communities continues to focus on enhancing its portfolio and maximizing returns for its investors. As the real estate market evolves, the REIT remains committed to its strategic objectives and operational excellence. The management team is optimistic about future developments and is dedicated to delivering value in the coming quarters.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

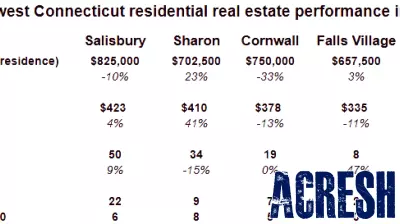

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...