February 1, 2025: Mortgage Rates Experience Another Decline

February 1, 2025 - 21:05

Today's mortgage rates on February 1, 2025, are in the mid-6% range, presenting a favorable opportunity for homebuyers despite the challenges posed by ongoing inflation. This latest drop in rates is encouraging for those looking to enter the housing market or refinance their existing loans.

As inflation continues to impact various sectors of the economy, the decrease in mortgage rates provides a silver lining for potential homeowners. Many experts believe that this trend may stimulate demand in the housing market, as lower borrowing costs can make homeownership more accessible.

Buyers are advised to take advantage of the current rates while they last, as market conditions can change rapidly. With the Federal Reserve's ongoing adjustments to monetary policy, future rate movements remain uncertain. However, for now, the mid-6% range offers a unique window of opportunity for those seeking to secure favorable financing terms.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

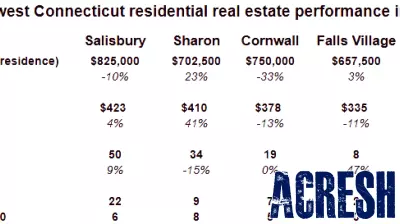

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...