Elon Musk Advocates for Overhaul of U.S. Federal Reserve Policies

December 25, 2024 - 01:24

In a bold move, Elon Musk has called for significant reforms at the U.S. Federal Reserve, emphasizing the need for cuts and enhancements in monetary policy. The tech entrepreneur and CEO of multiple companies expressed concerns over the central bank's current approach, arguing that it lacks the efficiency necessary to adapt to the rapidly changing economic landscape.

Musk highlighted the importance of a more streamlined and responsive monetary policy that can better address the challenges posed by inflation and economic uncertainty. He believes that by implementing strategic cuts and improving operational efficiency, the Federal Reserve can foster a more stable economic environment that benefits both businesses and consumers.

His remarks come at a time when many are questioning the effectiveness of traditional monetary policies in tackling modern economic issues. Musk's proposals could spark a broader debate on how central banks should evolve to meet the demands of a dynamic global economy. As discussions continue, the implications of these reforms could reshape the future of U.S. economic policy.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

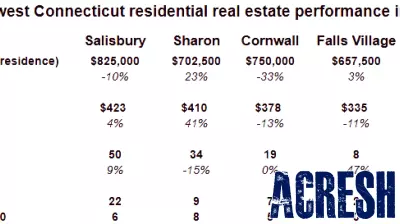

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...