Economic Growth Trends in U.S. Metropolitan Areas for 2023

January 23, 2025 - 04:35

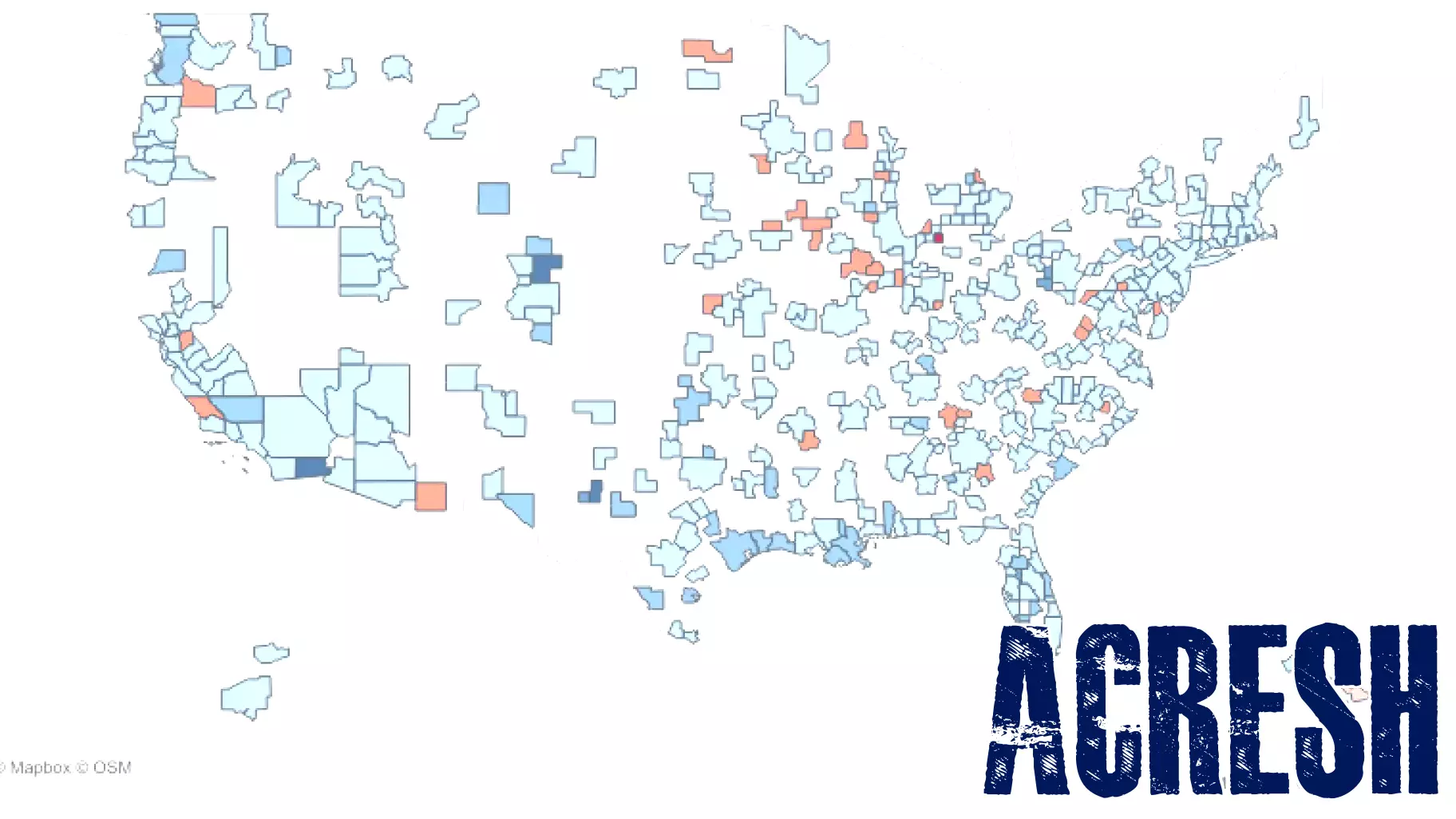

In 2023, the real GDP of U.S. metropolitan areas experienced a notable increase of 2.7%. A significant contributor to this growth was the "real estate, rental, and leasing" sector, which added 0.34 percentage points to the overall GDP. In contrast, the construction sector faced challenges, resulting in a contraction that deducted 0.11 percentage points from growth figures.

While many metropolitan areas aligned with the national growth trajectory, each region exhibited distinct economic characteristics influenced by local factors. For instance, some areas thrived due to robust housing market activity and increased demand for rental properties, while others struggled with rising construction costs and labor shortages that hampered development projects.

These diverse economic narratives underscore the complexity of the U.S. economy, highlighting how regional dynamics can significantly impact growth rates. As metropolitan areas continue to evolve, understanding these trends will be crucial for policymakers, investors, and residents alike.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

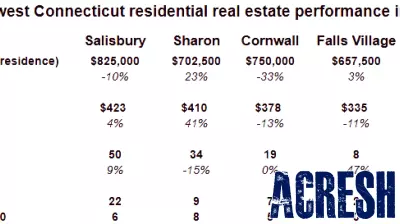

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...