DOGE Claims Over $600 Million in Real Estate Savings but Walks Back on Assertions

May 14, 2025 - 15:58

DOGE recently made headlines by asserting that it had achieved over $600 million in real estate savings. However, the company has since been forced to revise these bold claims, leading to a considerable amount of confusion and skepticism among stakeholders. Initially, DOGE touted these savings as a significant achievement, suggesting a strong commitment to financial efficiency and operational optimization.

In the weeks that followed, the narrative shifted as DOGE began to clarify its statements, revealing that the actual savings were far less than originally claimed. This backtracking has raised questions about the company's transparency and the accuracy of its financial reporting. Investors and analysts are now scrutinizing the implications of these adjustments, as the discrepancies could affect DOGE's credibility in the market.

The situation has sparked discussions regarding the importance of accurate communication in corporate reporting, especially in a competitive landscape where trust plays a vital role in consumer and investor confidence. As DOGE navigates this challenge, it will be crucial for the company to restore faith among its stakeholders.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

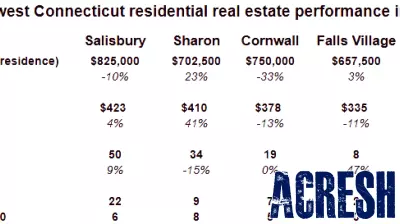

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...