Ares Commercial Real Estate Announces 2024 Dividend Distribution Details

January 31, 2025 - 13:02

Ares Commercial Real Estate has unveiled its dividend distributions for 2024, confirming a quarterly payment of $0.25 per share. Notably, a significant portion of these dividends, approximately 89.7%, qualifies as Section 199A dividends, which are subject to favorable tax treatment under the U.S. tax code.

This classification is particularly beneficial for investors, as it allows them to potentially deduct up to 20% of the qualified dividends from their taxable income, enhancing the overall yield of their investments. The company has also released a comprehensive breakdown of the tax classifications for its dividend payments, providing transparency and clarity for shareholders.

As investors look ahead to the upcoming year, the announcement underscores Ares Commercial Real Estate's commitment to delivering value through consistent dividend payments while leveraging advantageous tax structures. This strategic approach is expected to attract both existing and new investors seeking income-generating opportunities in the real estate sector.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

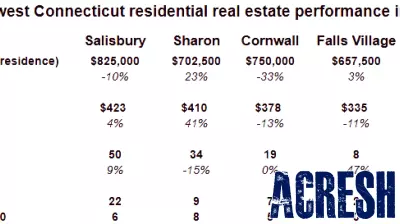

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...